How Venture Debt Warrants Work: A Founder’s Guide

You need $2–5 million to hit your next growth milestone, but giving up 25% equity in a Series B feels premature. This is the classic founder’s dilemma. While venture capital is a common path, the dilution can be steep. Venture debt provides an alternative—but it comes with unique terms, specifically warrants.

This guide explains how venture debt warrants work, what to expect, how to measure the risk, and what it means for your cap table. It also highlights how a strategic lender like Forge Capital can help structure terms that protect your growth and ownership.

What Is a Warrant in a Venture Debt Deal?

A warrant gives a lender the right—but not the obligation—to buy a specific number of your company’s shares at a preset price (the strike price) before a set expiration date.

Think of it as a long-term stock option for the lender. They provide the loan, and in return, they have a chance to share in your company’s upside.

If your company grows in value, the lender can exercise the warrant, buy shares at the original lower price, and realize a return.

If your company doesn’t meet growth expectations, the warrant expires worthless.

Most venture debt warrants last 5–10 years, providing lenders a long-term stake without impacting your immediate cash flow.

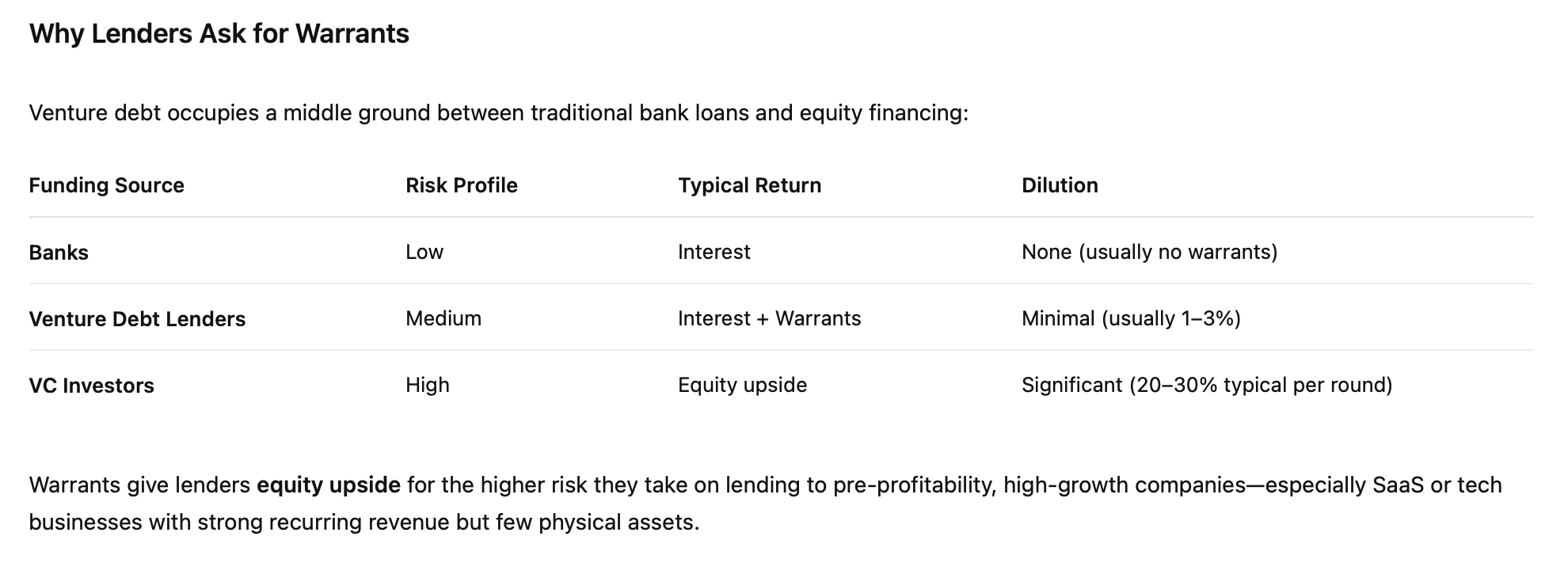

Table describing why venture debt lenders ask for warrants

How Much Equity Dilution Should I Expect?

The potential dilution is determined by warrant coverage, expressed as a percentage of the loan amount. Typical coverage ranges from 5–30%, depending on risk.

Example:

Loan Amount: $4M

Warrant Coverage: 10% → $400K worth of stock

Resulting Dilution: Typically 1–2% of total equity if exercised

The key takeaway: warrants represent a small slice of ownership, not a controlling stake.

How Is the Warrant Strike Price Determined?

The strike price is the price per share the lender pays if they exercise the warrant. Three common methods:

Price of Last Equity Round – straightforward, set at the per-share price of your most recent round (Series A, B, etc.)

Negotiated Value – if no recent round exists, lender and founder agree on a fair valuation based on revenue, growth, and market comparables

Discount to Future Equity Round – the strike price is set at a discount (e.g., 15–25%) to your next funding round, giving the lender upside for taking early risk

Benefits of Warrants for Founders

While warrants create potential dilution, they offer several advantages:

Access to Less-Dilutive Capital: Get the funds you need without giving up 20–25% of equity in a traditional round

Future Cash Injection: Exercised warrants bring cash into the company

Aligned Interests: Lenders with warrants are motivated by your long-term success, providing a more aligned partnership than a traditional creditor

Strategic lenders , like Forge Capital, not only provide financing but also structure warrant terms thoughtfully, ensuring founders maintain flexibility and runway while preserving ownership.

Risks of Issuing Warrants

For founders:

Future Dilution: If your company succeeds and warrants are exercised, your ownership stake decreases

Selling Shares at a Discount: Lenders can buy at the original strike price, which may be far below current valuation

For lenders:

Warrants may expire worthless if the company doesn’t grow past the strike price

Warrants have no voting rights and pay no dividends

Founder FAQs

1. Can I negotiate warrant coverage?

Yes. Strong financial metrics, recent equity rounds, or multiple term sheets can help reduce coverage, shorten the warrant term, or structure alternatives like success fees.

2. What happens if my company is acquired before warrants are exercised?

Typically, warrants are cash-settled or converted to shares before the sale. Terms vary by agreement, so review carefully.

3. Can warrants be repurchased or cancelled?

Some lenders will cancel or buy back unexercised warrants after loan repayment or a set period. This can reduce future dilution if negotiated upfront.

Why Partnering with the Right Lender Matters

Not all lenders understand the nuances of venture debt and warrants. A partner like Forge Capital brings:

Expertise in structuring debt and warrants to maximize runway with minimal dilution

Strategic guidance on fundraising, performance milestones, and capital allocation

Alignment with your long-term growth objectives, not just short-term loan returns

With the right partner, venture debt can give you the capital you need now while keeping your equity intact for the future.

Conclusion

Venture debt warrants may seem complex, but they are a strategic tool for founders seeking growth capital without excessive dilution. By understanding how warrants work and choosing a partner that values flexibility and alignment, like Forge Capital, startups can leverage venture debt to bridge funding gaps, reach milestones, and maintain control over their company.